Employee Retention Tax Credit

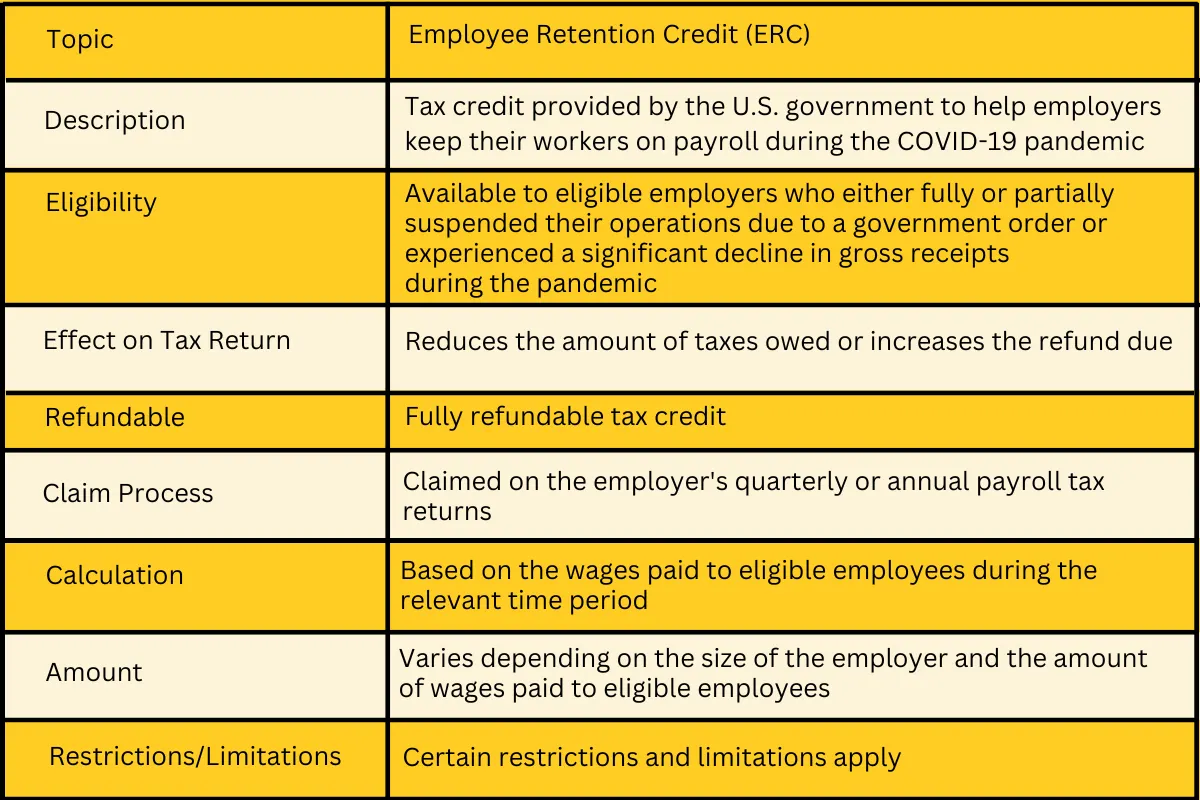

Employee retention credit (ERC) is an incentive program created to encourage employers to keep their staff members on the payroll and aid companies in recovering from the COVID-19 pandemic's adverse economic effects. Employers can claim this tax credit when they keep workers on staff and pay their salaries.

Depending on how much they have settled in wages, eligible employers may be qualified for up to $5,000 per employee in ERC. This post will go through how the ERC impacts your income tax return and offer suggestions for getting the most out of this tax credit. We'll discuss qualifying standards, credit applications, and other crucial factors.

To help you decide whether or not applying for ERC is right for you, we'll also discuss some of the potential drawbacks. By the time you finish reading this article, you should have all the knowledge you require to comprehend how the employee retention credit impacts your tax return and know if you qualify for the ERC.

Employee Retention Credit is reported on a business’s payroll tax return as an eligible credit. This credit can be used to offset the employer’s portion of Social Security taxes that are due for wages paid to employees affected by COVID-19.

The amount of the ERC is generally equal to 50% of qualified wages up to $10,000 per employee, with a maximum credit of $5,000 per employee.

To report this credit on the tax return, businesses should enter their total qualified wage expenses and related credits in Form 941, Employer's Quarterly Federal Tax Return, or Form 944, Employer's Annual Federal Income Tax Return.

Additionally, businesses should complete Schedule R (Form 941), Allocation Schedule for Aggregate Form 941 Filers, or Section C of Form 8974 to calculate the total amount of Employee Retention Tax Credit. If you did not claim the ERC and later discovered that you were eligible for the ERC, you may amend your Form 941.

Depending on the unique circumstances of each instance, the answer to the question of whether ERC refunds are taxable varies.

In general, a refund of excess retirement plan contributions made by an employer that were not previously counted toward the employee's taxable income is not subject to taxation. Any refund of such excess contributions, however, might be taxed if they were previously part of the employee's taxable income.

Any repayment of such earnings would likewise be liable to taxation if any earnings on those donations were included in income. Therefore, before deciding whether their ERC refunds are liable to taxation, taxpayers should carefully analyze their unique conditions.

To account for this credit, you must accurately calculate and document the amount of qualified wages paid to each employee.

You'll need to report any qualified wages and associated credits on your annual tax return using Form 941 or your quarterly estimated tax payments using Form 941-X. Additionally, depending on the size of your business, you may also be required to file Form 7200 with the IRS to claim the Employee Retention Credit.

It is important to note that businesses who receive Paycheck Protection Program (PPP) loans cannot claim the credit, so make sure you understand which types of loans are eligible for the credit before filing.

Employee Retention Credit (ERC) is a tax credit available to employers in 2020 and 2021, intended to help employers who have been affected by the COVID-19 pandemic. The credit is available for qualified wages paid after March 12, 2020 federal income tax, and before January 1, 2021.

The amount of the credit depends on several factors including the number of employees retained and the wages paid. When an employer claims ERC on their tax return, it reduces their federal income tax liability dollar for dollar up to a maximum of $5,000 per employee for each taxable year.

This can be an excellent way for businesses to reduce their overall taxes due in a given tax year and help them financially during these difficult times.

The ERC lowers payroll tax expenses by offering a refundable credit of up to 50% on annual salaries totaling up to $10,000 per employee. As a result, businesses can only claim a maximum of $5,000 in credits for salaries provided to each employee during the relevant period.

The ERC likewise covers the employer's payments under the health plan during this time frame. Overall, by giving companies a much-needed financial boost during these difficult times, the ERC assists employers in lowering payroll tax expenses.

By claiming the ERC on your tax return, you will be able to receive a refundable payroll tax credit worth up to 85% of qualified wages paid from March 13, 2020, through December 31, 2021.

This can help you save money on taxes and potentially enable you to retain more employees during this difficult time. It's important to note that all employers must fill out Form 941 and include the ERC when preparing their quarterly returns to be eligible for this credit.

Your business may greatly benefit from the Employee Retention Tax Credit. You can save thousands of dollars per employee and get a cash flow refund if you are eligible. It can be challenging to file your ERC tax filings appropriately; however, experts from the Employee Retention Tax Express are on standby to help you out.

© 2024 ERTCexpressreviews.com. All Rights Reserved.